If security return has perfect correlation with return on market portfolio, CML coincides with SML. It depicts individual security risk premium as a function of security risk This makes the risk-return expectation linear, whereas the CAL is a curved frontier. The CML integrates a weighted percentage of risk-free assets. The CAL demonstrates an efficient frontier for a portfolio of risky assets. It represents the risk premium of efficient portfolios as a function of portfolio standard deviation. The CML is a special version of the Capital Allocation Line (CAL). Difference between Capital Market Line (CML) and Security Market Line (SML) Capital Market Line For a given amount of systematic risk, security market line shows the required rate of return.

#CAL VS CML FREE#

This is the difference between the expected market return and the risk free rate. Objectives: The current study aims to evaluate the prevalence of thyroid dysfunction in a sample of Iraqi patients with CML (chronic phase) treated with nilotinib and its possible. Nilotinib has been reported to be associated with hypothyroidism and hyperthyroidism.

Risk premium on a risky security equals to the market risk premium. Background: The use of tyrosine kinase inhibitors has dramatically improved the prognosis of chronic myeloid leukemia (CML).

#CAL VS CML PLUS#

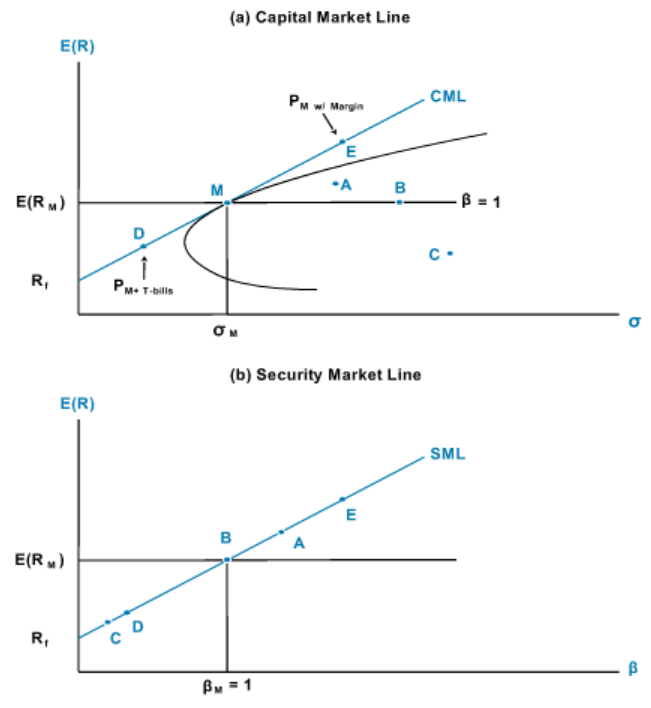

The risk premium on a risky security is equal to a risk free rate plus the risk premium of the risky security. Security Market line with systematic risk is measured by Beta. Rm = the expected return on market portfolio rapidQ&A for CFA Exam Level I 2021 R53 Portfolio Risk and Return: Part II R53.b capital allocation line (CAL) and capital market line (CML). Where, E(Rj) = expected return on security Therefore the equation for Security Market Line is as follows – Capital Allocation Line (CAL) on the other hand. Similarly a risk free security has no volatility hence its beta is equals to zero. While standard deviation is the measure of risk in CML, Beta coefficient determines the risk factors of the SML. The beta market portfolio is equals to 1. Beta is a standardised measure of a security’s systematic risk. Σ²M (Covar j,m)/ σ²M represents the security beta. Risk and return relationship is represented as below –Į(Rj) = Rf + (Covar j,m) This is shown by the variance of the market return (σ²M). So the return on market portfolio should depend on its own risk. Moreover the co-variance of any asset is represented by its variance. Systematic risk is the co-variance of an individual risky security with the market portfolio. The risk in the individual risky securities is the systematic risk. ALOA Security Professionals AssnMississippi Gulf Coast Community College. Under Capital Asset Pricing model, risk of an individual risky security refers to the volatility of the security’s return vis – a – vis the return of the market portfolio. explain the capital allocation line (CAL) and the capital market line (CML) About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How YouTube works Test new. Education, Certification and Operations Manager. Security Market Line is the representation of capital asset pricing model (CAPM).

0 kommentar(er)

0 kommentar(er)